In order to guarantee a buyer for the interest in a business (particularly a minority interest which may be of very little value to one’s heirs), consideration should be given to a lifetime agreement among the business owners as to how to dispose of the business.

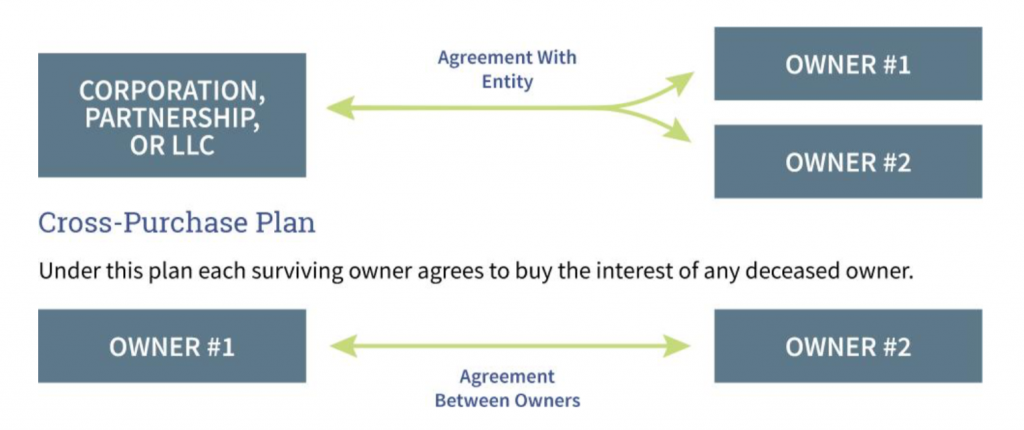

Entity Plan

Under an entity plan the organization buys the interest of the deceased business owner. This type of arrangement is often used when there are several owners.

An attorney should be consulted in deciding which plan is better.

Advantages of Buy-Sell Agreements

- Guarantees a buyer for an asset that probably will not pay dividends to one’s heirs.

- Can establish a value for federal estate tax purposes that is binding on the IRS. See IRC Sec. 2703.

- Spells out the terms of payment and is easily funded with life insurance and disability insurance.

- Provides a smooth transition of complete ownership, management, and control to those who are going to keep the business going.

Funding a Buy-Sell Agreement

Buy-sell agreements are frequently funded with life insurance. Under the provisions of IRC Sec. 101(j), death proceeds from a life insurance policy owned by an employer on the life of an employee are generally includable in income, unless certain requirements are met. If these regulatory requirements are met, the proceeds can be received income-tax free. State or local law may vary. Professional legal and tax guidance is strongly recommended.