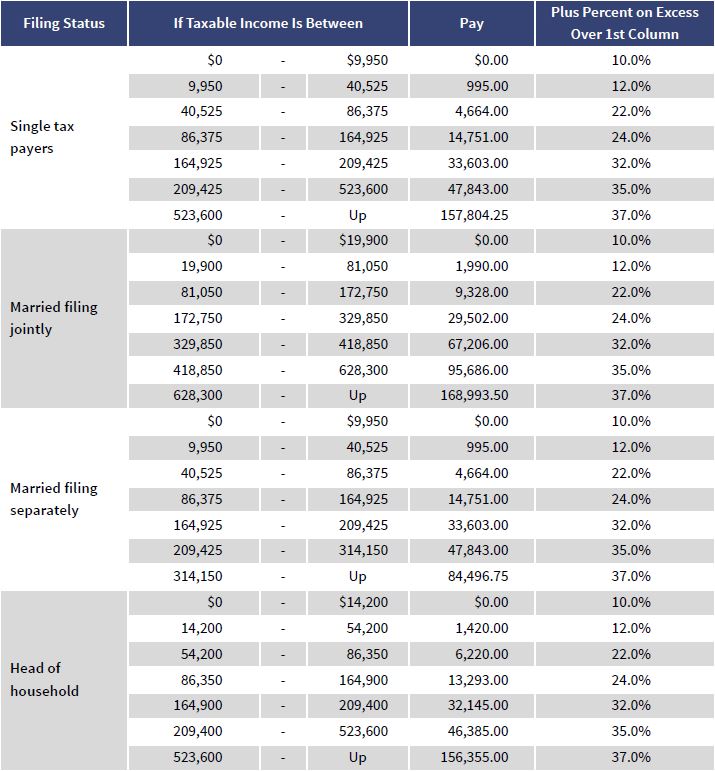

Federal Income Tax Tables – 2021

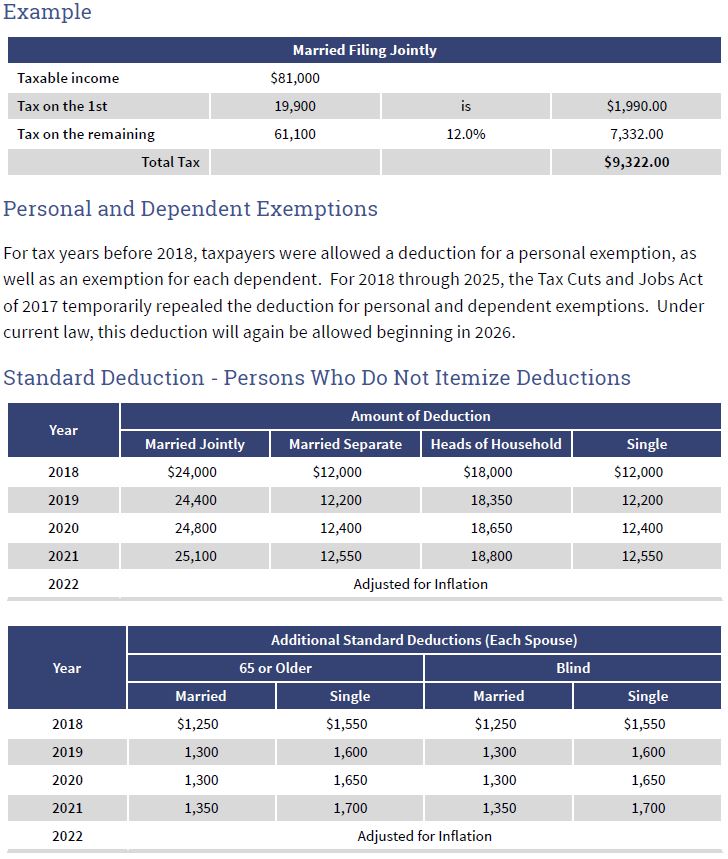

Standard Deduction for Dependents

The standard deduction for an individual who can be claimed as a dependent on someone else’s return is limited. For 2021, this deduction is generally limited to the greater of (1) $1,100 or (2) the individual’s earned income, plus $350, not to exceed the regular standard deduction amount.